The Time Monetization Framework: A New Canon for Capital Sovereignty

I. Introduction: Time as the First Currency

"Time is the fire in which we burn."

- Delmore Schwartz

In an age of relentless quantification - where wealth is measured in digits, yield curves, and profit margins - we have lost sight of the primordial currency that underwrites all value: time.

Time is not merely a resource; it is the atomic substrate of existence, the irreducible denominator of labor, capital, attention, and meaning. Every transaction, every innovation, every act of creation or destruction is, at its core, a negotiation with time.

Yet, in the grand ledger of modern economics, time remains an afterthought, subordinated to the abstractions of fiat currency and market cap.

The Time Monetization Framework is a restoration - a recalibration of financial analysis that reasserts time as the sovereign unit of valuation, productivity, and resilience. This framework is not merely a set of metrics; it is a philosophical rebellion against the temporal myopia of contemporary capitalism. It posits that true wealth is not the accumulation of capital but the liberation of time, and that the highest form of sovereignty is the mastery of one’s temporal destiny.

The Forgotten Currency

Time is the ultimate non - renewable resource. Unlike capital, which can be borrowed, leveraged, or conjured from thin air, time is finite and irreversible. Every human endeavor - whether the toil of labor, the deployment of capital, or the pursuit of innovation - is a wager against time’s inexorable march.

Yet, traditional financial metrics, from return on investment (ROI) to net present value (NPV), obscure this reality. They fetishize monetary outputs while ignoring the temporal inputs that make them possible.

This oversight is not merely academic; it is existential. In a world where labor is commodified, attention is harvested, and capital is weaponized, the erosion of temporal sovereignty has become a crisis of human dignity.

The Time Monetization Framework seeks to reverse this tide by providing a new canon - one that measures not just what we gain, but what we sacrifice in the currency of hours, days, and years.

Philosophical Underpinnings

The centrality of time in value creation is not a novel idea. Karl Marx’s labor theory of value, for instance, posits that the value of a commodity is determined by the socially necessary labor time embedded within it.

However, Marx’s framework, while prescient, is incomplete. It fails to account for the exponential leverage afforded by technology, the antifragility of certain assets, and the cosmic scale of value preservation.

The Time Monetization Framework transcends these limitations by integrating insights from complexity theory, information economics, and existential philosophy. It draws upon the works of thinkers such as:

Henri Bergson, who argued that time is not a linear sequence but a durée - a lived, qualitative experience.

Nassim Taleb, whose concept of antifragility informs our understanding of resilience in the face of volatility.

Ludwig von Mises, who emphasized the subjective nature of value and the role of human action in economic calculation.

By synthesizing these perspectives, the TMF offers a holistic model that captures both the quantitative and qualitative dimensions of time monetization.

II. Bitcoin as the Crystallization of Time

Bitcoin is not merely a digital currency - it is time, crystallized. Each block is a timestamped shard of reality, an immutable testament to the flow of events within a shared network of consensus.

Just as a clock tracks the movement of hands across a dial, Bitcoin’s blockchain marks time through cryptographic proof, anchoring fleeting transactions in a permanent sequence.

Every validated block is a cosmic timestamp - an artifact of human energy, computation, and attention transmuted into something real, irreversible, and universally acknowledged. This temporal architecture transforms the blockchain into more than a ledger; it becomes a chronicle of existence, etched not in sand, but in cryptographic stone.

As with the stars whose light travels across millennia to reach us, each Bitcoin block is a signal from a moment now sealed in the continuum.

In this sense, Bitcoin is a cosmic mirror - it reflects the existential movement from potential to actuality, recording that movement with absolute finality.

This is why Bitcoin dovetails so precisely with the Time Monetization Framework: it provides the only monetary system in history that honors time’s irreversibility, scarcity, and continuity.

Where fiat currency abstracts value from time, Bitcoin grounds it in time’s very structure. It is the first financial instrument to encode entropy-resistance at the protocol level.

If TMF is the existential mirror of time efficiency, then Bitcoin is the existential record of time sovereignty.

Time, Scarcity, and the Finality of Blocks

Each Bitcoin block represents not just transactions, but sacrifices—of energy, attention, and opportunity. These are the same elements measured in TMF’s multidimensional time inputs: labor, capital, attention, emotional resilience.

Bitcoin’s fixed supply amplifies this perspective. Just as life’s finitude grants meaning to each moment, Bitcoin’s scarcity reinforces the urgency of each temporal decision. There are only so many blocks, just as there are only so many heartbeats in a life. In this way, Bitcoin acts as a spiritual instrument—imposing discipline, reflection, and intentionality upon capital flows.

Where fiat expands infinitely and erodes meaning, Bitcoin compresses value into a structure that aligns with the metaphysics of time itself: irreversible, finite, sequential, and real.

Philosophical Implication: Bitcoin as Temporal Sovereignty Infrastructure

If capital is a claim on future time, then Bitcoin is a fortress for that claim - a time vault immune to manipulation, decay, or confiscation. It is the embodiment of what the TMF calls Temporal Sovereignty: the power to liberate one’s future from the entropy of the present.

Bitcoin, therefore, is not merely compatible with the TMF - it is the TMF’s most perfect vessel.

Bitcoin is the sacred ledger where capital meets cosmos.

It is not just the measure of time monetization - it is the immortalization of time itself.

III. The Time Monetization Ratio (TMR): The Existential Mirror

"Productivity is not just about doing more; it is about creating more time." - Unknown

Definition The Time Monetization Ratio (TMR) is the foundational metric of the framework. It quantifies the efficiency with which an entity—be it an individual, corporation, or nation—transforms time sacrifices into Bitcoin-equivalent capital output.

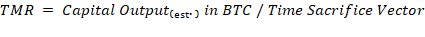

Mathematically, it is expressed as:

Where:

Capital Output₍ₑₛₜ.₎ in BTC: Total monetary value generated by the entity, converted into Bitcoin equivalent value using current BTC/USD rates.

Time Sacrifice Vector = αL + βK + γA + δE

· L: Labor Sacrifice (human hours dedicated to output)

· K: Capital Machine Time (operational machinery, software runtime)

· A: Cognitive Load (intellectual attention, decision-making energy)

· E: Emotional Resilience (psychological cost of volatility, uncertainty)

· α, β, γ, δ are contextual weightings for each component of time

Philosophical Significance

TMR is more than a measure of productivity - it is a reflection of how much time must be sacrificed to mint durable value into the economic reality. It aligns the metric directly with Bitcoin’s essence: time preserved, not time spent.

High TMR indicates a company that achieves high output with minimal temporal sacrifice, and whose value generation is more likely to endure beyond fiat distortion. Low TMR indicates temporal servitude - value born from a higher rate of existential exhaustion.

Adjusted Metrics for Modeling

To sharpen the metric further, two new tools emerge:

1. BTC-TMR Industry Baselines — benchmarking TMR relative to other firms in the sector, normalized in BTC.

2. Fiat Time Dilution Index (FTDI) — a modifier that adjusts TMR downwards to reflect fiat erosion.

Adjusted TMR = TMR * (1 - FTDI)

Modeling Implications

In stock modeling, TMR becomes the temporal efficiency score, answering not "how profitable is this firm," but "how much immortalized time does it create per unit of temporal sacrifice?"

This transforms TMR into a weapon for evaluating capital through the lens of Bitcoinized time.

It reveals operational efficiency and time-sovereign truth.

IV. TMRD - Time Monetization Ratio Delta: The Arbitrage of Time

"In the gap between time given and time taken lies the arbitrage of empires." - Anonymous

Definition

TMRD quantifies the delta between two entities’ Time Monetization Ratios. It exposes the asymmetry in how efficiently each entity transforms sacrificed time into Bitcoin-equivalent capital. It is calculated as:

TMRD = TMRₐ - TMRᵦ

Where TMRₐ and TMRᵦ are the respective time monetization ratios of Entity A and Entity B.

Interpretation

TMRD is a lens of temporal arbitrage: a measure of which entity more effectively escapes the entropy of time.

A positive TMRD means Entity A generates more Bitcoin-equivalent value per unit of time than Entity B.

This signals:

· Operational Superiority: Entity A has a more refined Time Sacrifice Vector.

· Temporal Advantage: Entity A has achieved greater sovereignty over fiat degradation.

· Capital Positioning Opportunity: Entity B is a candidate for reinvestment or restructuring toward Bitcoin-aligned operations.

Advanced Refinement:

Structural Temporal Arbitrage

Beyond surface TMRD, we apply a structural adjustment model to account for compositional differences in time input vectors:

TMRD adjusted = (TMRₐ - TMRᵦ) ÷ √[(αₐ - αᵦ)² + (βₐ - βᵦ)² + (γₐ - γᵦ)² + (δₐ - δᵦ)²]

This adjusted TMRD considers not only output differences but underlying efficiency architecture - ideal for peer benchmarking.

Philosophical Significance

TMRD reveals the ethics of capital in a world governed by time. Those with high TMRD wield temporal power, often unknowingly extracting from the time sacrifice of others. In Bitcoinized modeling, TMRD forces confrontation with this imbalance and invites a rebalancing of capital structures to align with sovereign time principles.

V. TMRE - Time Monetization Ratio Efficiency: The Entropy of Time

"Time waste differs from material waste in that there can be no salvage."

- Henry Ford

Definition

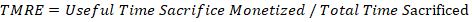

TMRE measures the proportion of time sacrifice that is effectively transmuted into Bitcoin-equivalent value, as opposed to being lost to inefficiency, redundancy, or entropy.

It reflects the precision of temporal deployment within an entity’s operations.

Where:

Useful Time Sacrifice Monetized refers to the time inputs that contribute directly to Bitcoin-denominated capital output.

Total Time Sacrificed includes all time expended, including inefficiencies and waste.

Operationalizing TMRE

To determine TMRE, the Time Sacrifice Vector is decomposed into:

· Productive Time Sacrifice (Lₚ, Kₚ, Aₚ, Eₚ)

· Entropic Time Sacrifice (Lₑ, Kₑ, Aₑ, Eₑ)

Thus: TMRE = (αLₚ + βKₚ + γAₚ + δEₚ) / (αL + βK + γA + δE)

This allows a company to assess how much of its sacrificed time is sovereign, versus how much is lost to fiat-structured bureaucracy, misaligned incentives, or internal chaos.

Modeling Tools for TMRE Optimization:

Time-Flow Mapping - Identify bottlenecks and friction zones within organizational flow.

Cognitive Load Diagnostics - Quantify attention fatigue and innovation leakage.

Emotional Entropy Audits - Assess burnout, emotional volatility, and morale degradation.

Strategic Implications

A high TMRE score signifies a company that stewards time-sacrifice wisely, channeling effort into high-leverage, entropy-resistant outcomes. It is a signature of operational sovereignty.

A low TMRE score, even in high-output firms, signals systemic waste - a bleeding of existential energy into unproductive realms. It warns of diminishing returns despite high surface-level revenues.

Adjusted TMRE for Bitcoinized Modeling

As with TMR, TMRE can be normalized through Bitcoin equivalence:

Adjusted TMRE = TMRE × TMR

This compound score captures not only how efficiently time is used, but how meaningfully that time is converted into enduring value measured against time itself (Bitcoin).

Philosophical Significance

In a world where time leaks through the cracks of attention debt and bureaucratic inertia, TMRE becomes a moral compass. It asks: "Are we building monuments of time, or just burning hours into smoke?"

TMRE is where the spiritual meets the strategic - a mirror for how an enterprise honors the sacred currency of existence.

VI. TMRV - Time Monetization Resilience Value: The Antifragility of Time

"The clock is running. Make the most of today. Time waits for no man."

- Unknown

Definition

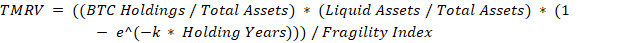

The Time Monetization Resilience Value (TMRV) evaluates the durability and antifragility of an entity’s time - monetized capital, particularly when stored in assets that resist entropy, such as Bitcoin. It is conceptually formulated as:

Where:

BTC Treasury % is the proportion of the entity’s capital held in Bitcoin.

Liquidity Score measures the ease of converting assets to cash without loss.

Holding Duration Score reflects the entity’s commitment to long-term value preservation.

Systemic Fragility Index assesses exposure to macroeconomic risks (e.g., inflation, currency devaluation).

Antifragility and Time Crystals

TMRV is grounded in Nassim Taleb’s concept of antifragility - systems that gain from disorder. In the context of time monetization, antifragility means preserving and even enhancing value across temporal volatility.

Bitcoin, often described as a time crystal, embodies this principle. Its decentralized, deflationary nature makes it resistant to the entropic decay of fiat currencies, which are eroded by inflation and political whims. By holding Bitcoin, entities convert their time - monetized capital into a form that is not only preserved but potentially amplified over time.

Mathematical Refinement

To make TMRV actionable, we can define each component rigorously:

BTC Treasury % = BTC Holdings / Total Assets

Liquidity Score = Liquid Assets / Total Assets

Holding Duration Score = A function of the average holding period, e.g., 1

, where k is a decay constant.

Systemic Fragility Index = A composite index incorporating inflation rates, currency volatility, and geopolitical risk.

Thus:

Philosophical Dimension

TMRV transcends mere financial resilience; it is a statement about temporal sovereignty. Entities with high TMRV are not just surviving time’s passage - they are thriving within it, converting volatility into opportunity. This is the essence of cosmic valuation: aligning one’s capital with assets that endure beyond the ephemeral cycles of fiat and equity markets.

VII. TMRG - Time Monetization Return on Growth: The Leverage of Time

"Scale is the ability to do more with less - less time, less effort, less sacrifice."

- Anonymous

Definition

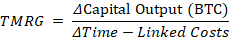

The Time Monetization Return on Growth (TMRG) measures an entity’s ability to scale capital growth without proportionally increasing time - linked costs. It is conceptually defined as:

Where:

ΔCapital Output (BTC): the increase in Bitcoin-equivalent revenue or value over a given period.

ΔTime-Linked Costs: The change in total weighted time inputs over the same period (Δ(αL + βK + γA + δE))

Interpretation

A high TMRG means the entity achieves growth without a corresponding increase in time cost, often through:

· Software scalability

· Content leverage

· Network effects

· IP-based exponential delivery

A low or stagnant TMRG reveals growth that is merely linear - tethered to time-expanding costs such as added labor hours, management drag, or bureaucratic scaling.

Exponential vs. Linear Time Monetization

Linear Growth = TMRG ≈ 1 (each unit of growth requires an equal unit of time sacrifice)

Exponential Growth = TMRG >> 1 (each new output requires marginal time sacrifice approaching zero)

Bitcoinization of TMRG

In a Bitcoin-denominated paradigm TMRG captures not only how well a company scales, but whether its scaling perpetuates temporal sovereignty.

If capital growth is exponential but fiat-denominated and fragile, TMRG becomes an illusion.

If capital growth is exponential and stored in Bitcoin, TMRG becomes a mechanism of compounding time crystallization.

Thus, Adjusted TMRG = TMRG × TMRV

Strategic Implications •

High TMRG + High TMRV = A business model that both scales and preserves time-monetized capital.

High TMRG + Low TMRV = A business model that may scale but squanders its temporal legacy to fiat decay.

Low TMRG + High TMR = A steady-state company with preserved output, but limited exponential leverage.

Philosophical Reflection

TMRG is the metric of temporal multiplicity - the art of multiplying impact without multiplying effort.

In the age of Bitcoinized time, true leverage is not just financial, but cosmic - bending the arc of time-effort away from grind and toward liberation.

Those who master TMRG do not just scale companies - they scale consciousness. They extract from each hour a lifetime of value, and transmute fleeting effort into permanent inscription on the Bitcoin ledger of history.

VIII. The TMF Dashboard: A Strategic Model for Temporal Sovereignty

"What gets measured gets remembered. What gets remembered becomes eternal." – TMF Principle

The Time Monetization Framework culminates in a five-dimensional dashboard that allows investors, strategists, and sovereign capital allocators to evaluate entities through the lens of temporal efficiency, preservation, and growth, all benchmarked against the Bitcoin standard of time.

Each metric serves a distinct philosophical and analytical role:

TMR (Time Monetization Ratio) – The Core Efficiency Score

Measures how effectively time sacrifices are converted into Bitcoin-equivalent capital.

Reveals existential productivity and time sovereignty.

TMRD (Time Monetization Ratio Delta) – The Temporal Arbitrage Lens

Measures asymmetries in time monetization across entities.

Highlights opportunities for capital repositioning, optimization, or strategic reinvention.

TMRE (Time Monetization Ratio Efficiency) – The Entropy Gauge

Assesses the internal precision of time deployment.

Distinguishes sovereign operations from entropic wastelands.

TMRV (Time Monetization Resilience Value) – The Time Preservation Index

Evaluates the antifragility and longevity of time-monetized capital.

Rewards Bitcoin-aligned treasuries and entropy-resistant asset allocation.

TMRG (Time Monetization Return on Growth) – The Temporal Leverage Score

Captures the company’s ability to scale capital without scaling time sacrifice.

Identifies exponential leverage versus linear grind.

Integrative Dashboard Model

The TMR Dashboard is not just a reporting tool - it is a philosophical compass. It maps the trajectory of an entity’s relationship to time:

Is it efficient in time conversion (TMR)?

Is it entropically disciplined (TMRE)?

Is it antifragile across volatility (TMRV)?

Is it capable of scalable temporal leverage (TMRG)?

How does it compare to others in the temporal field (TMRD)?

Example Archetypes:

• The Temporal Fortress: High TMR + High TMRE + High TMRV + High TMRG → A sovereign enterprise, structurally aligned with Bitcoin’s metaphysics.

The Grind Engine: High TMR, Low TMRV → Appears efficient but erodes output via fiat entropy.

The Fragile Flame: High TMRG, Low TMRE/TMRV → Rapid growth but highly vulnerable to collapse.

The Legacy Leviathan: Low TMR, Low TMRE, High TMRV → An aging empire coasting on preserved capital but failing to renew time efficiency.

Strategic Utility

The TMR Dashboard allows:

Investors to target time-sovereign companies.

Operators to diagnose entropic loss points and restructure for exponential time leverage.

Capital allocators to rank companies not by fiat illusion, but by the enduring crystallization of time.

Temporal Alpha

True alpha is not found in quarterly earnings, but in a company’s multi-metric temporal synthesis. The TMR Dashboard decodes this synthesis - and illuminates where sovereign capital should flow next.

IX. Cosmic Valuation and the Sovereign Capital Thesis

"Bitcoin is a time machine for value."

- Anonymous

Beyond the metrics lies a deeper thesis: cosmic valuation. This is the idea that true wealth is measured not in fiat or equity but in entropy - resistant assets that preserve value across time and space.

The Hierarchy of Temporal Assets

Fiat Currency: A decaying store of value, eroded by inflation.

Equities: Tied to corporate performance, vulnerable to market cycles.

Intellectual Property: Infinite leverage but subject to obsolescence.

Bitcoin: A decentralized, deflationary asset that resists entropy.

By converting time - monetized capital into Bitcoin, entities achieve temporal sovereignty - freedom from the gravitational pull of fiat decay and centralized control.

Philosophical Implications

This thesis challenges the very foundations of modern finance. It suggests that the pursuit of wealth is not merely about accumulation but about transcending time’s constraints. In this light, Bitcoin is not just an investment; it is a philosophical statement - a declaration of independence from temporal tyranny.

X. Conclusion: Toward Time Sovereignty

"The future belongs not to those who work hardest, but to those who escape the time trap."

- Anonymous

The Time Monetization Framework is more than a set of analytical metrics. It is a metaphysical blueprint for a new era of value measurement, one that centers the human condition around its most finite, most sacred asset: time.

In this updated paradigm, we no longer ask how much capital an entity generates in fiat abstractions.

We ask how effectively it transforms time into Bitcoin-equivalent value - how well it crystallizes the fleeting into the eternal.

The Time Monetization Ratio becomes the existential mirror.

TMRE becomes the entropy filter.

TMRD becomes the arbitrage compass.

TMRV becomes the antifragile vault.

TMRG becomes the lever of cosmic scale.

Together, they do not merely measure productivity - they form the philosophical scaffolding of temporal liberation.

And at the center of this framework is Bitcoin, as the first economic instrument capable of expressing time’s sacred irreversibility in digital form.

Bitcoin anchors value to the passage of moments, etches it into incorruptible stone, and elevates economic modeling from guesswork to cosmic law.

The Time Monetization Framework calls upon investors, creators, leaders, and sovereign entities to rethink wealth - not as the accumulation of currency, but as the stewardship of time.

Not as growth for growth’s sake, but as the alchemy of permanence through leveraged temporal design.

The world is entering the Bitcoin Age - and in this age, value is not counted in dollars, but in blocks. In time preserved. In sovereignty earned.

The Time Monetization Framework is a guide to spiritual reckoning with the clock of existence.

Let those who seek alpha now seek temporal alpha. Let those who build wealth now build time-resilient citadels. Let those who measure profit now measure immortality per sacrifice.

Time is the true capital.

Bitcoin is its measure.

And the Time Monetization Framework is its philosophy made real.